Bitcoin Hits Resistance After Institutional Buying Surge and Political Tailwinds

- Bitcoin ETF inflows surged to yearly highs, signaling strong institutional demand.

- Political and regulatory shifts add momentum but raise market volatility risks.

- On-chain data and sentiment point to a possible short-term BTC correction.

Bitcoin approached resistance levels this week following bullish catalysts, including substantial ETF inflows, institutional investment announcements, and notable political developments. The price action saw BTC rise, testing the $94,000 level before encountering selling pressure. Analysts now caution that signs of a temporary top are beginning to form despite the upward momentum.

Bitcoin saw one of its most active weeks in terms of institutional flows. According to SoSoValue, spot Bitcoin ETFs recorded net inflows of $912 million on April 22 and $917 million on April 23—the highest two-day inflow since January 17, 2025. These inflows came alongside a sharp uptick in trading volume and were accompanied by technical breakouts across several major moving averages.

MicroStrategy’s subsidiary, Strategy, added 6,556 BTC to its holdings for a reported $555 million. The purchase increased the company’s total Bitcoin exposure and reinforced corporate confidence in BTC as a treasury asset. Separately, Cantor Fitzgerald, Tether, and SoftBank launched a new $3.6 billion Bitcoin investment firm, indicating growing institutional interest in Bitcoin-backed financial products.

Bloomberg also referred to Bitcoin as a “safe haven,” a notable shift in narrative from previous years. The change in tone reflects how traditional financial media increasingly frames Bitcoin as a portfolio hedge amid global uncertainty.

Regulatory and Political Signals Shift Market Expectations

Regulatory-wise, 72 crypto ETF applications are still pending approval by the U.S. Securities and Exchange Commission. This comes before the next SEC crypto roundtable on April 25, when newly appointed Chair Paul Atkins, known for his pro-crypto position, is set to address.

In collaboration with Crypto.com, Trump Media said it will start several ETF programs. The announcement coincided with a rise in the TRUMP memecoin , which shot up following official channels’ confirmation of a gala dinner invitation for the top 220 token holders. Former President Donald Trump said on his own that fresh tariffs might allow tax cuts for Americans, so fueling more general financial market speculation.

In a legal development, Alabama dropped its enforcement action against Coinbase, signaling a potential easing of regulatory pressure on crypto service providers.

On-Chain and Sentiment Metrics Indicate Caution Ahead

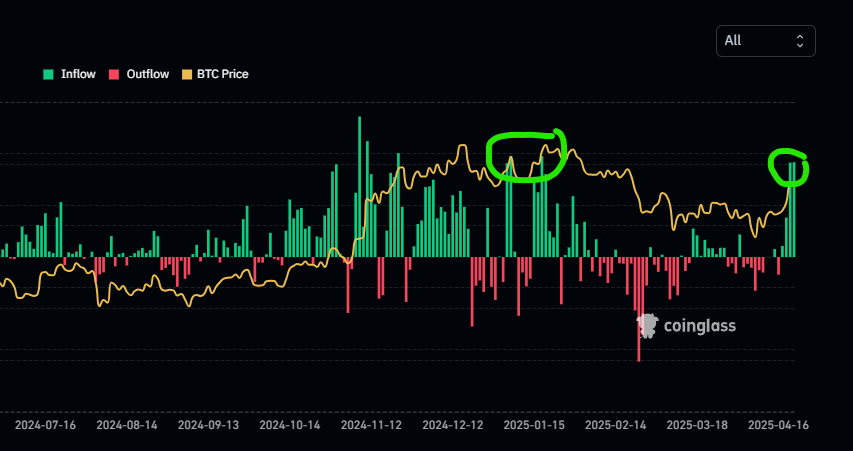

CoinGlass data reveals net BTC exchange inflows during the recent price rise. A comparable trend was seen in mid-January, when high inflows came before a local top and following price drop. The present inflow trend has generated worries about possible profit-taking or short-term fluctuations.

The Crypto Fear & Greed Index rose to 63 this week, returning to the “Greed” territory for the first time since February. Historically, such sentiment peaks have coincided with short-term market tops. Data shows that the index has remained neutral for longer, making the current greed levels relatively uncommon.

Technical indicators also suggest a possible momentum pause. The daily StochRSI indicates Bitcoin is now overbought, and price movement has stopped at a significant resistance area close to $94,000. Should BTC not maintain the support level between $90,000 and $91,000, analysts predict a potential retracement toward $87,000 to let market signals reset.

Shiba Inu And Cardano Made Millionaires In 2021, FloppyPepe (FPPE) Will Make Billionaires In 2025

While Shiba Inu (SHIB) and Cardano (ADA) created millionaires in 2021, this new presale coin, Floppy...

FOGNET and DepinTech Unveil a User-Driven Future for Easy Web3 Communication

The innovative company FOGNET established a strategic partnership with DepinTech, a leader in decent...

Richard Heart Triumphs in Court After SEC Case Dismissed in Full

NEW YORK, U.S./NY, 25th April 2025, Chainwire...